This month’s peanut market report is focussed mostly on the situation in the US. The recent weather caused additional delays in the East and created damages in the West. Overall, quality seems good compared to previous years, but quantity is expected to be less than initially forecasted. Demand is good, and the market bottom could already have been reached.

Update on US weather & harvest situation

Right now, the harvest is progressing quickly in the Southeast, and we are in the final 30%. Hurricane Zeta was basically no factor in the Southeast but did add to the delays in the Virginia-Carolinas area. The Southeast did receive some minor rains in the past week, but the only real effect was that it gave the buying points time to catch up.

There is no real rain the forecast until around Saturday in the Southeast (40% chance), so harvest should continue to progress nicely. West Texas is also forecasted to be dry this week, and the Virginia-Carolinas area should be mostly dry until mid-week next week.

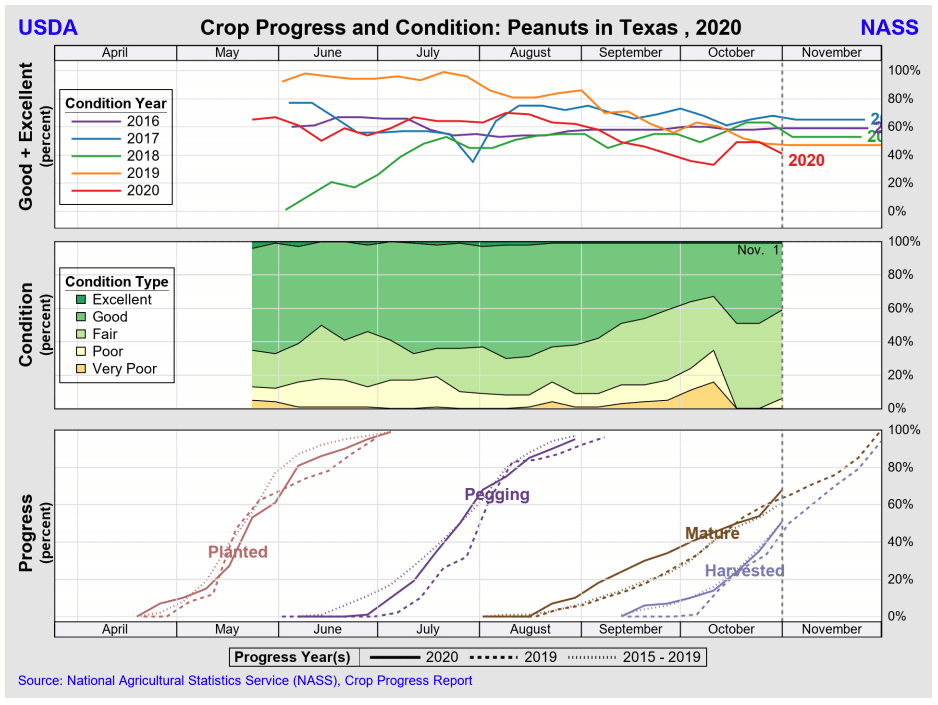

The southwest experienced a significant freeze mid-week last week, which was problematic. The market for Spanish type peanuts was already extremely tight and this of course just worsened the situation for both the Spanish as well as the Runners and Virginias in that area. Organic production was also affected.

Some shellers are noticing an increase in freeze damage, as a result, in the West Texas harvest along with lower yields (see front picture).

Yields in southern Texas are much better so far.

Market update

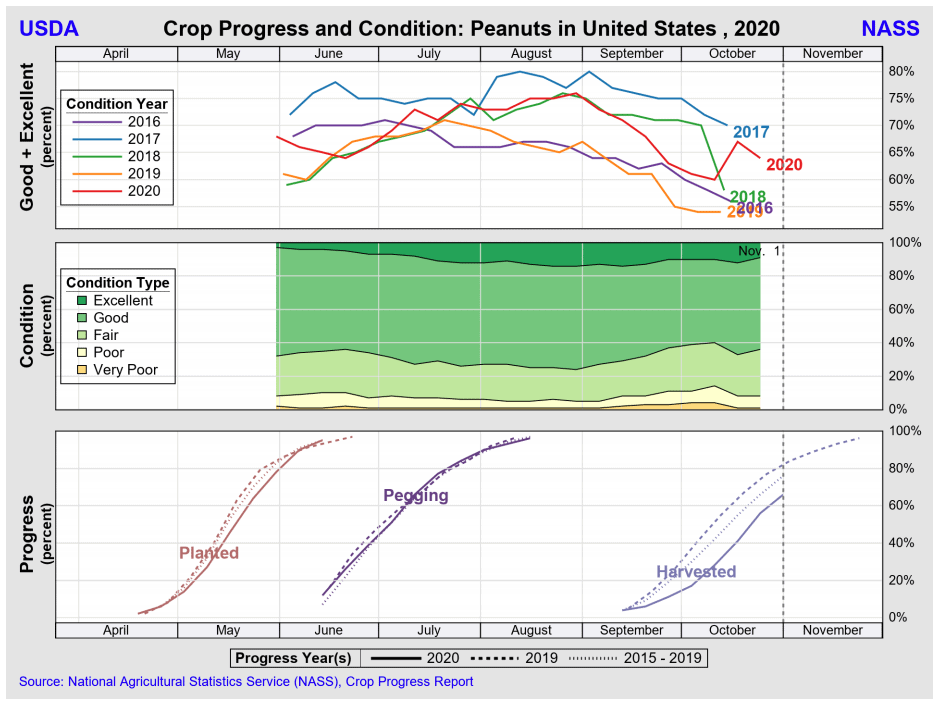

The market in the US has found some strength in the past few weeks as shellers have experienced delays with the harvest in virtually every growing region (see graphs below) and, aside from South Texas, are finding that the yields are not in line with the government’s forecast nor with their own expectations. Meanwhile, China and India have also continued to deal with delays with their harvest because of the rains, so the demand from China has continued to be very strong- both in the form of kernels and farmer stock.

Most in the industry think that the market has found its bottom at levels which are higher than bottoms in previous years and some shellers have withdrawn from the market.

Should China exit the market at the beginning of 2021 we could see the market take a breather but, so far, the interest is strong between now and then and demand for peanut butter both domestically and in other markets is extremely strong.

Quick update on South America

Although plantings have been delayed by more than one month, the recent rain allowed for some plantings in the southwest of São Paulo state. However, the rainfall has been irregular, in frequency but also spatial distribution. Some areas more at the North of the state barely received any rainfall. There, preparations and plantings are stoped for now. The uncertainty of the rainfall patterns in the coming months because of the delays and the presence of La Niña calls for a risk-reduction farming strategy this year to mitigate potential unfavourable events (weather & plague related) and impact on yields.

In Argentina, the rains arrived just on time to allow for plantings without causing too many delays. Nevertheless, the amount of rain perceived was probably just enough to compensate for the drought of the past months and more rain is necessary for the coming weeks to allow for a good start of the crop.

For more information on other origins, we recommend reading our previous Peanut market report.

Westplein 58

Westplein 58

We use cookies to ensure you get the best experience on our website. For more information, please read our

We use cookies to ensure you get the best experience on our website. For more information, please read our