Market update North America and China

Currently, the market in the US is very quiet. Demand in the US is of course very strong and the demand for peanut butter is insatiable both in the US and Canada. Demand from Mexico has weakened as a function of the fact that much of that demand is for snack nuts and candies and the virus continues to decimate demand. Meanwhile, new purchases by China have basically dried up within the past few weeks as a result of a weakening of the market for current crop in China; the normal summer slowdown in imports; and as a result, in the industry’s expectation that plantings in China are up approximately 10%.

New sales to the EU from the US for current crop are virtually non-existent and, to a large degree, shellers are still reluctant to look at EU specs for new crop.

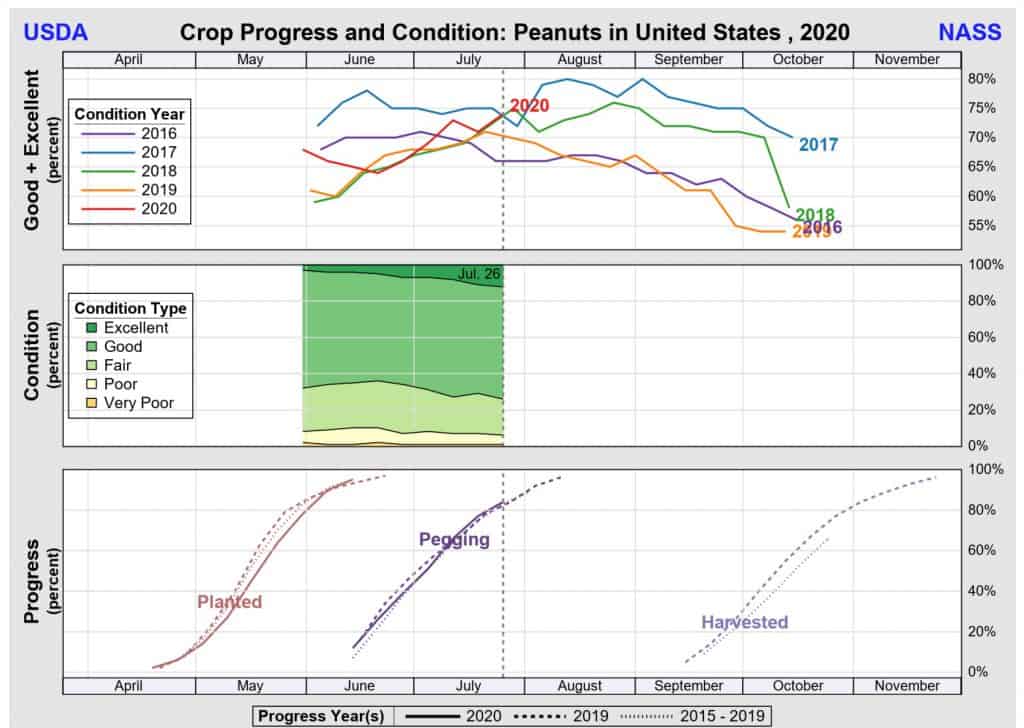

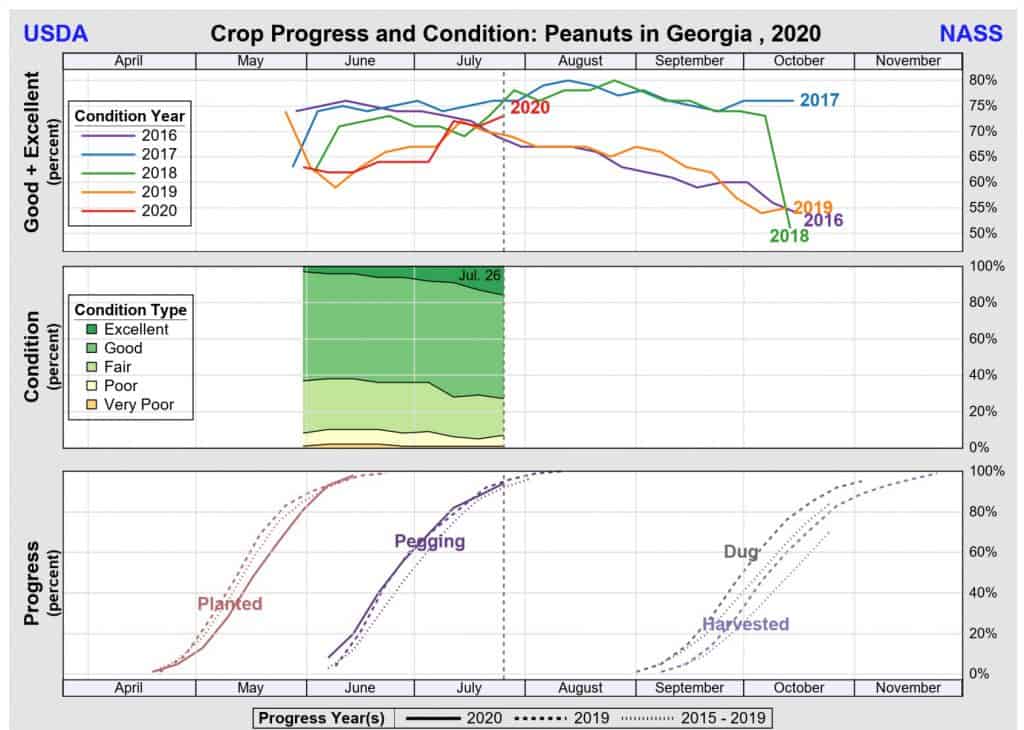

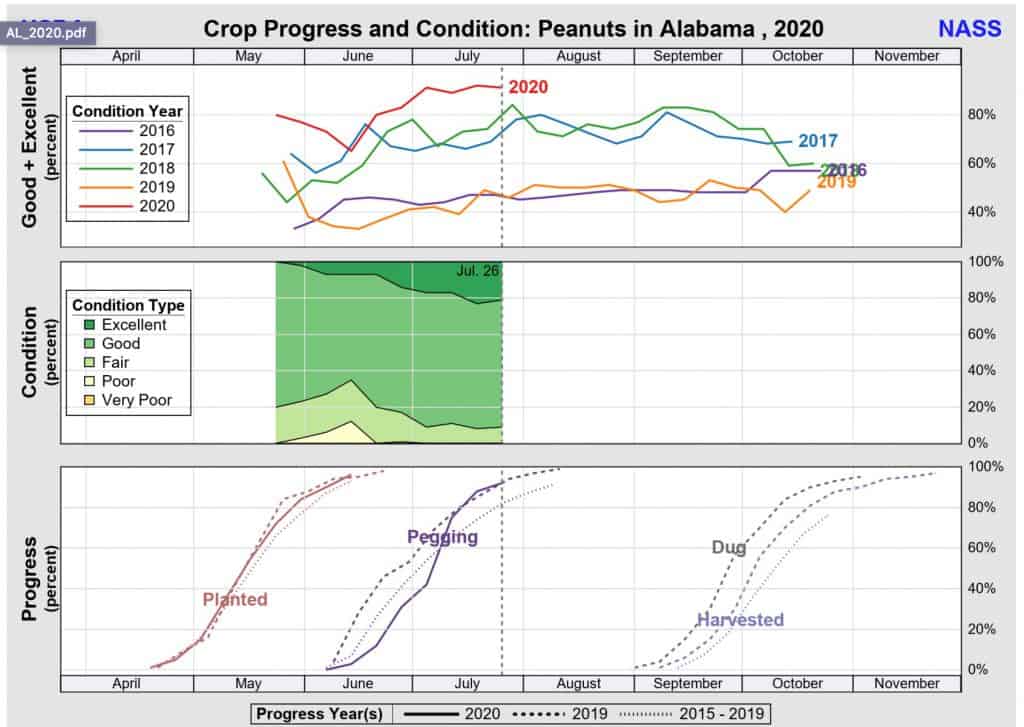

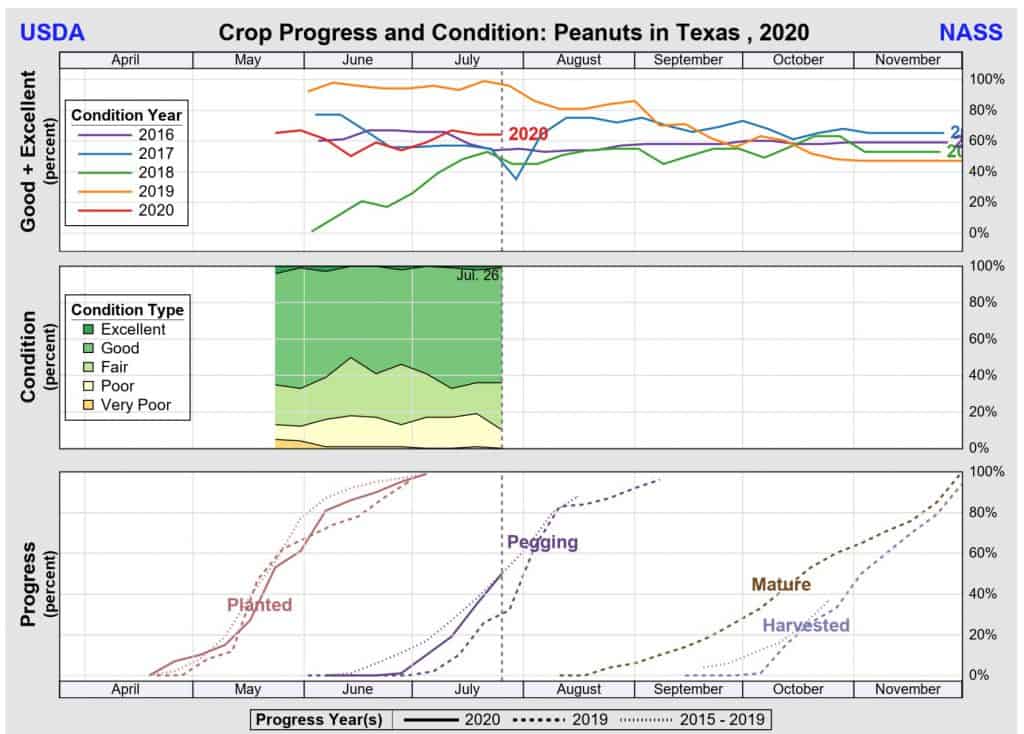

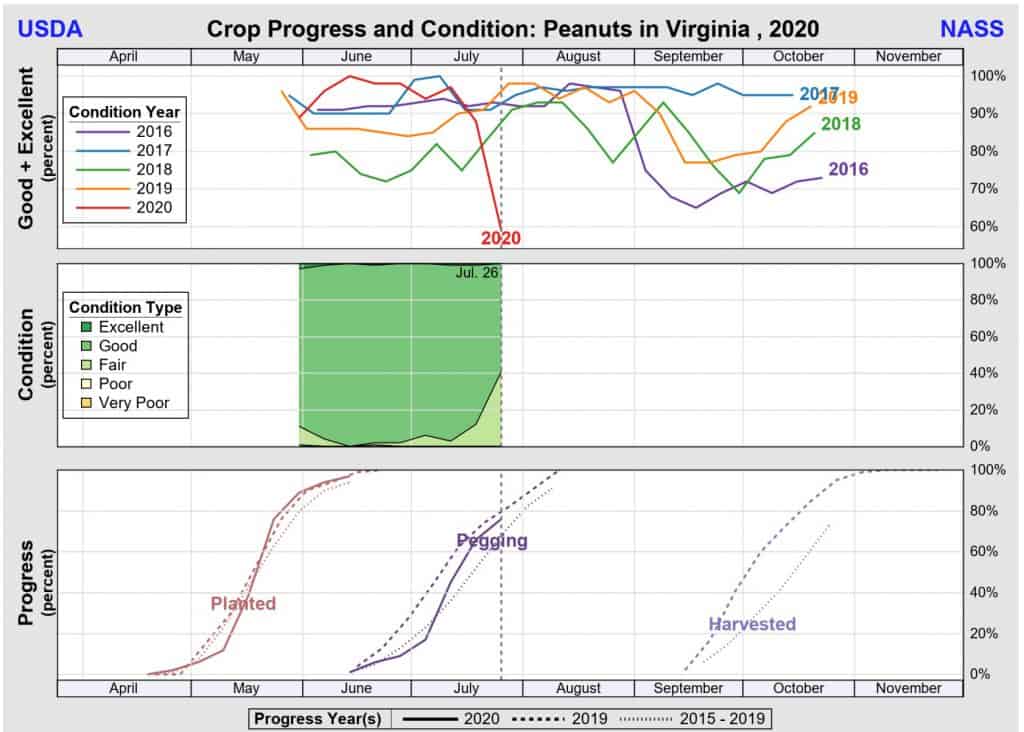

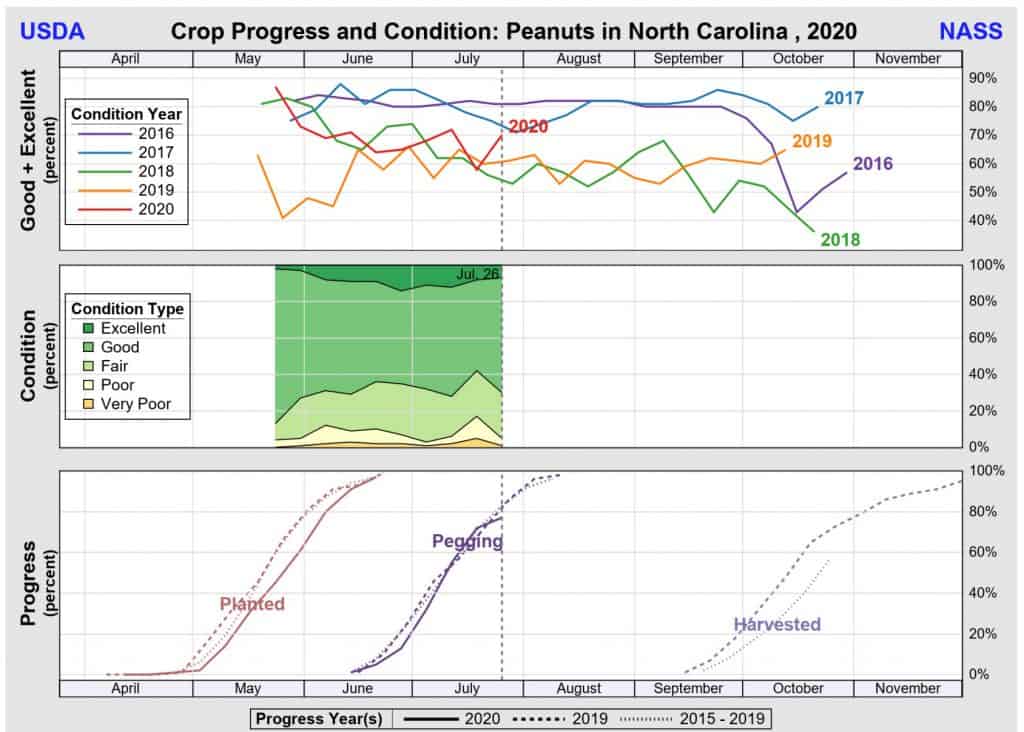

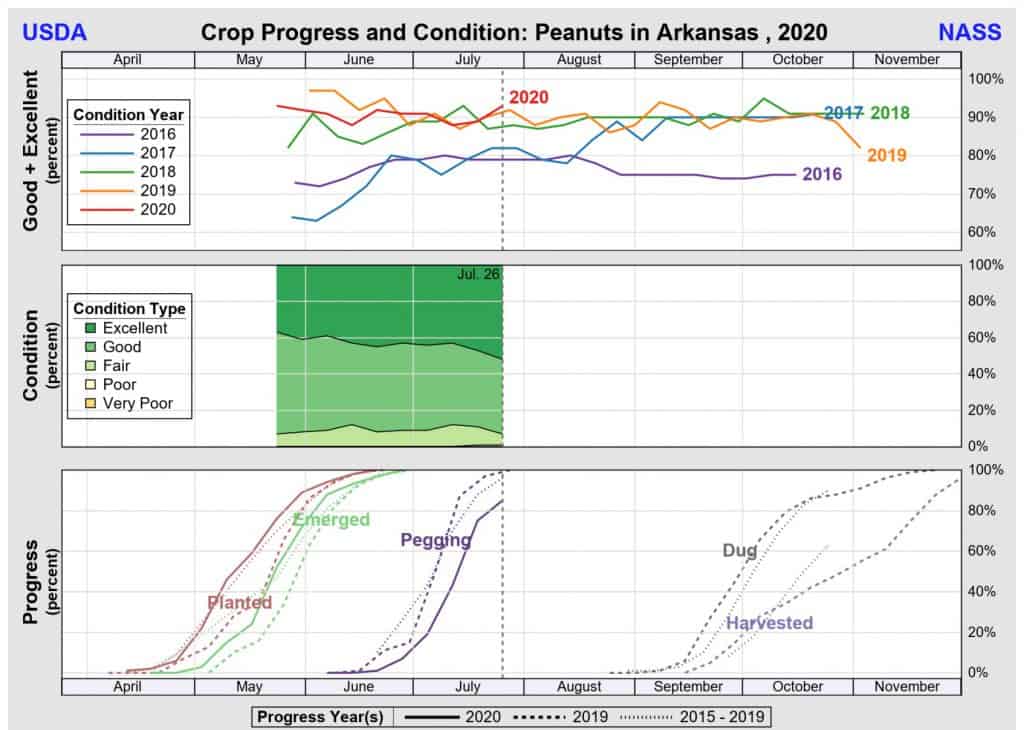

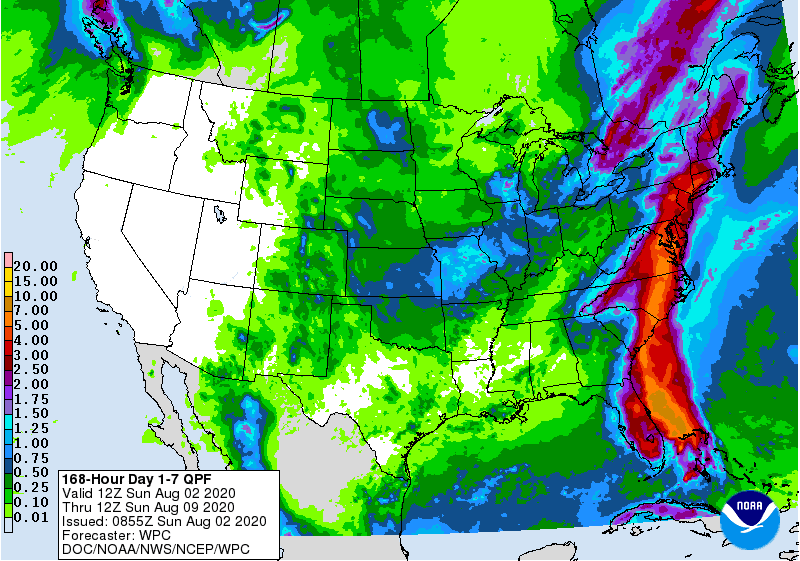

The overall crop in the US is in good shape although West Texas continues to struggle with heat and drought. Parts of Georgia are right on the fringe of being dry although spotty showers are continuing to pop up. Tropical Storm Isaias, unfortunately, won’t bring much in the way of rain to Georgia and the 7-day precipitation forecast shows very little rain in all but the Eastern most edge of Georgia. If anything, Isaias should draw moisture away from SW and Central Georgia growing areas. The Carolinas and Virginias will, however, receive very critical rainfall.

Generally speaking, shellers are off of the market for 2020 crop as they continue to monitor the crop and while they also work to secure the balance of the crop which, so far, could take longer than normal. Meanwhile, there is a modest gap between what manufacturers are willing to pay and what shellers are willing to discuss although the shellers are happy to wait. We would recommend that buyers have a sizeable layer of coverage for 2020 crop as the downside risk is much smaller than the upside risk. We do still feel, however, that planted acreage is higher than the government’s forecast of “up 6%”. We think it could be closer to up 10-13%. Prices for current crop domestically are around $.80/lb and remain elevated beyond October. New crop positions, for January forward, for the domestic market are in the lower $.50’s.

We use cookies to ensure you get the best experience on our website. For more information, please read our

We use cookies to ensure you get the best experience on our website. For more information, please read our